Importance of geology in evaluating mature fields

Since we first made note of it in Round 9 of our Weekly BPS newsletter in December of last year, Petrobras has gradually announced what is now Brazil’s largest divestment program of hydrocarbon exploration and production assets since 2015. The divestments are spread across several basins, including Potiguar, Espírito Santo, Santos, Solimões, Ceará, Alagoas, Camamu and Pará-Maranhão.

Ever since the breakup of the oil and gas monopoly in 1998, Petrobras has remained relatively dominant in exploration and production in onshore and shallow-water areas in Brazil, with its technical excellence being rewarded with a vast portfolio of highly successful production assets. However, the Brazilian oil major has started its transition towards a large-asset business model, shifting its portfolio significantly over the last couple of years. To focus on its highly attractive offshore assets, it has been selling off its reserves in onshore and shallow-water areas, which still have a lot of remaining oil in the ground. Although the volumes are not comparable to the pre-salt assets or other high-risk/high-reward deep-water acreage, the assets offer low technical risk for new players and will probably have strong ROI if the appropriate redevelopment techniques are applied.

It is worth emphasizing that BPS has performed integrated studies of the petroleum systems, oil quality distribution and a range of other aspects on all of the areas currently on offer. It is also important to mention that our BPS Geodatabase now has a user-friendly tool that automatically forecasts oil and gas production via Decline Curve Analysis of public production history data, which can be extremely useful in the initial assessment of the remaining value of the assets.

Applying petroleum systems to divestment opportunities

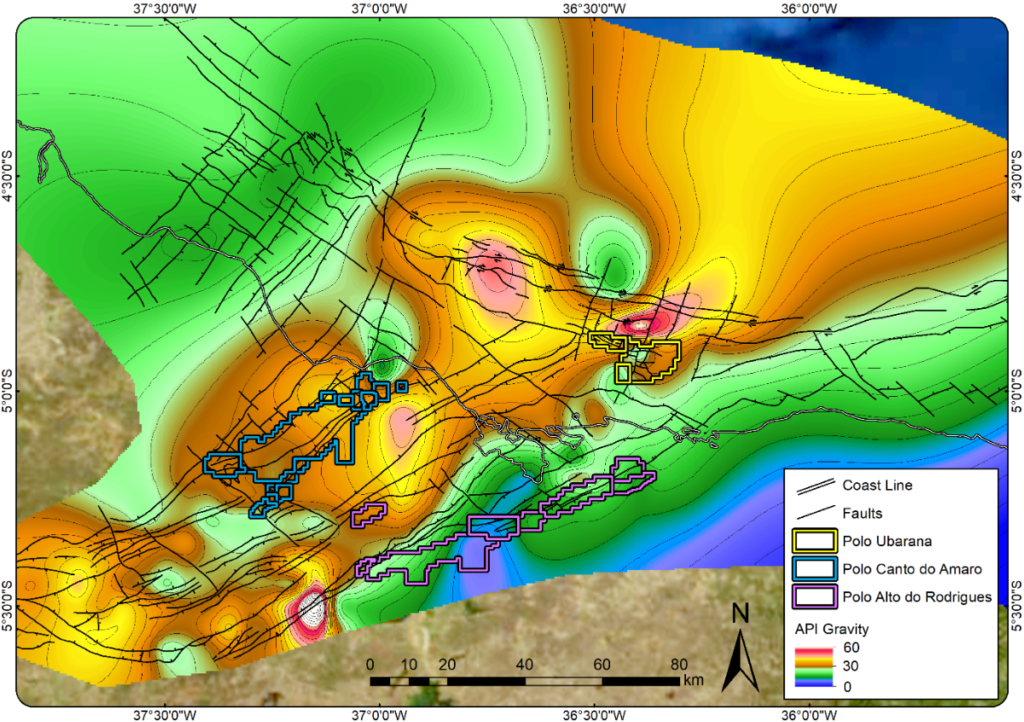

The Potiguar Basin, the most recent teaser to be announced, provides an interesting example of the importance of understanding the petroleum systems when evaluating the opportunities. If we look at the API gravity/oil quality distribution in the basin (Figure 1), the differing oil accumulations of the Canto do Amaro and Alto do Rodrigues clusters clearly show the compartmentalization of the reservoirs within the basin. The former has high API gravity (light oil), while the latter is a heavy oil system, thus requiring different recovery methods. This demonstrates the essential need for our proprietary Advanced Geochemistry Technology (AGT) in the redevelopment studies of the fields in each cluster, as the different styles of structural compartmentalization will certainly be key to defining the best alternatives for enhanced recovery, workovers and infill drilling.

Home / Importance of geology in evaluating mature fields